Search Options Trading Mastery:

- Home

- Explain Option Trading

- What is Options Trading

What is Option Trading?

What Is Option Trading and How Can We Make Money From It?

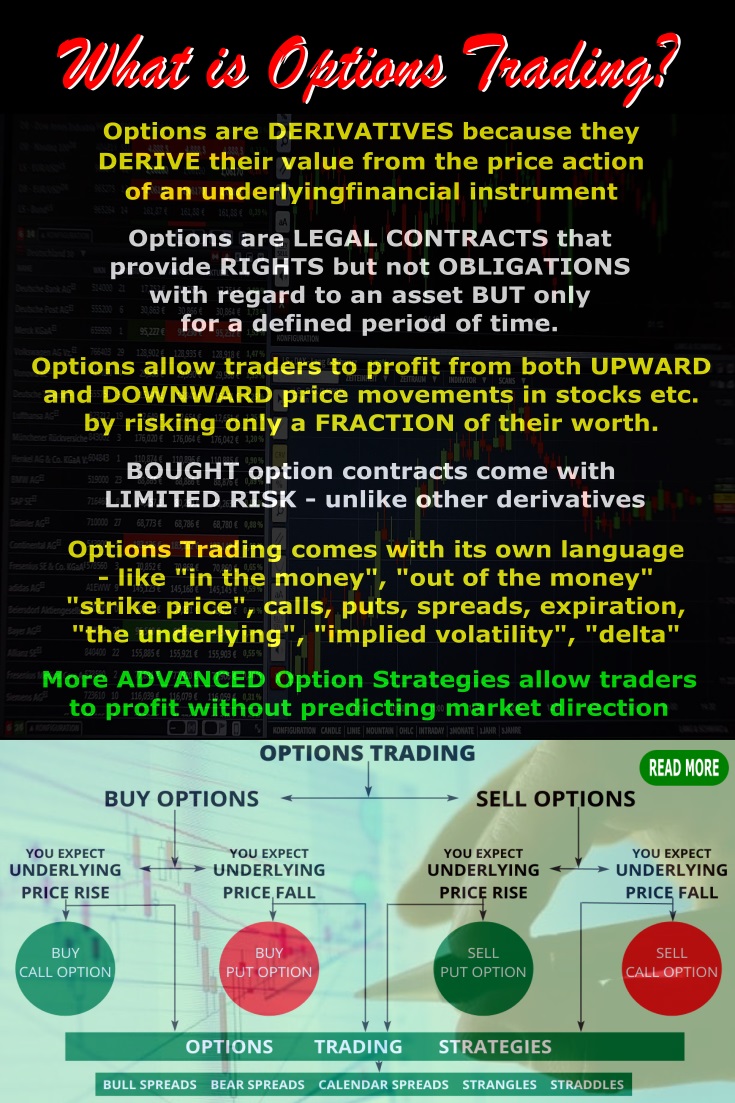

So what is option trading, you ask? Options are one class of a number of financial instruments known as derivatives. They are called "derivatives" because their price action is derived from the price action of another "underlying" financial instrument.

The most commonly known of these is stocks (shares) but you can also have options on currencies, commodities and even real estate.

Definitions

What is option trading without its own unique language! So let's define some concepts. An option contract gives the owner the right, but not the obligation, to buy or sell a given item for an agreed price (called the "strike price") up until an agreed expiration date.

If you are able to buy that item for a strike price which is less than the current market price at the time you want to do it, then your option contract has what they call "intrinsic value".

But the more common description for them is "in the money". Conversely, if you're in a position to sell an item for more than it's current market price when you choose to do it, then you also have "intrinsic value".

So your aim should be to either "call" on the market to sell you shares for less than today's share price, or alternatively, be in a position to "put" your shares to the market for more than today's price.

This is where "call options" and "put options" come in. We can see by now, that buying "call options" is a good idea when you think the underlying price will rise, because they will become more profitable as that occurs.

Put options on the other hand, is your derivative of choice when you think the underlying share price will fall.

But what is option trading without its advantages! The beauty of options is that, for a fraction of the cost of share trading, you can take advantage of both upward and downward movements in stock prices.

You also have a third alternative, suitable for more advanced option strategies, where you believe the underlying stock will remain within a trading range until option expiration date. These are called "range trading strategies".

The Power of Leverage

And what is option trading without leverage! The cost of an option contract in comparison to buying the stock outright is miniscule. By purchasing options instead of shares, you pay only a fraction of the price but receive all the benefits of price movements in the stock itself.

So if you purchased say, 10 'at the money' option contracts covering 1,000 shares in XYZ - and the XYZ's share price moved $2 in your anticipated direction, then you have just made yourself a cool $2,000.

You have done this, paying only a fraction of the cost of XYZ's stock price. This is leverage - less outlay for more profit. If the price goes against you and remains so until option expiration date, unlike other 'derivatives' the most you can lose is your initial outlay.

The Downside

Yes, but what is option trading without a downside! Unlike the underlying financial instrument (stocks, commodities etc) options do have an expiration date. You can't just hold onto them until "one day" they become profitable again.

When an option has no 'intrinsic value' (as above) then the only remaining component of its market price is "time value". This value is based on the probability that the option will achieve any intrinsic value before option expiration date.

The closer you get to expiration date the less likelihood of the option becoming profitable, so "out of the money" options will decline in value at an exponential rate as the end of their term draws near.

Flexibility

Now what is option trading without flexibility! The other interesting factor about these little gems, is that you can also "write" or sell (i.e. create) option contracts out of nothing. This ability to sell options to the market that you didn't previously own, enables us to create combinations of positions involving both "buy to open" and "sell to open" options at different strike prices and even different expiration dates. This takes us into the realm of advanced option trading strategies.

They say that 85 percent of options expire worthless, so if you have "sold" positions included in your strategy, you can lower the risk that you will lose money.

If you have a 'debit spread' for example, you can often take advantage of the underlying price going against you in the short term, by buying back the "sold" position for next to nothing. Your 'bought' position in the spread only has to return to close to its original price and you've made a profit.

Not only that, but the original position is much cheaper to set up than merely buying call or put options alone, so you can place these trades when you don't have a lot of capital.

So What is Option Trading?

It is a way of taking advantage of price movements in the financial markets, risking less money and with greater leverage for profits.

It does have a downside in the form of time decay, but if you understand how this works and harness it to work for you, you can use option trading to safely make an income for the rest of your life.

*************** ***************

Return to Explain Option Trading contents page

Return to Option Trading Homepage

New! Comments

Have your say about what you just read! Leave me a comment in the box below.