Search Options Trading Mastery:

- Home

- Option Trading Articles

- How Option Price Movements Effect Gains and Losses

How Option Price Movements Effect Gains and Losses

Knowing about and understanding how options work is a potent arrow in a trader’s quiver. One of the things that people new to options must understand is how a change in an option’s price will effect the value of their position and their gains and losses.

The first thing to know about options and price movements, is that options utilize leverage. Leverage is when a small amount of capital controls a larger amount of an underlying security. This is the case with options because one options contract is equal to one hundred shares of the underlying stock, ETF or index. A small percent change in the price of an underlying stock will result in a large move in the value of an options contract.

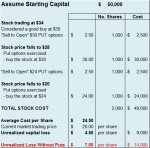

This can be best illustrated by looking at a typical options trade. If a stock is trading at 52 and you buy one 52 strike call option at a price of 2.5, you will need to pay 2.5 X 100 or $250. This is because you have one contract at 2.5. The multiplier is 100 because you are controlling 100 shares with each contract.

Consider a situation where the stock price goes to 53. The price of an option does not move 1 to 1 with the price of the underlying stock. The reason for this is beyond the scope of the article. Let’s say the price of the option moves up in price by .5 to 3, in this case. The gain in your position will be .5 X 100 or $50. The percent gain in the stock is the current price, minus the original price divided by the original price. So, (53-52)/52 or +1.9%. The percent gain in your options position is determined using the same formula. Your original position value is $250. The current value of your position is $250 plus your $50 gain, or $300. So, (300-250)/250 or +20%. Not bad.

Let’s say that the stock price goes to 51 and the price of your option goes to 2. The percent loss in the stock is (51-52)/52 or –1.9%. Your position losses –.5 X 100 or $50. So your percent loss is (200-250)/250 or –20%.

So, as you can see as the price of a stock moves up or down, the change in the value of your option position is magnified. This is fundamental to being able to execute proper position management when you are trading options.

Further Reading:

https://www.optionstrategies.info/option/basics