Search Options Trading Mastery:

- Home

- Index Options

- Spider Options Trading

Spider Options Trading - Trading the SPY

Spider Options Trading - A Better Alternative Than S&P500 Index Options

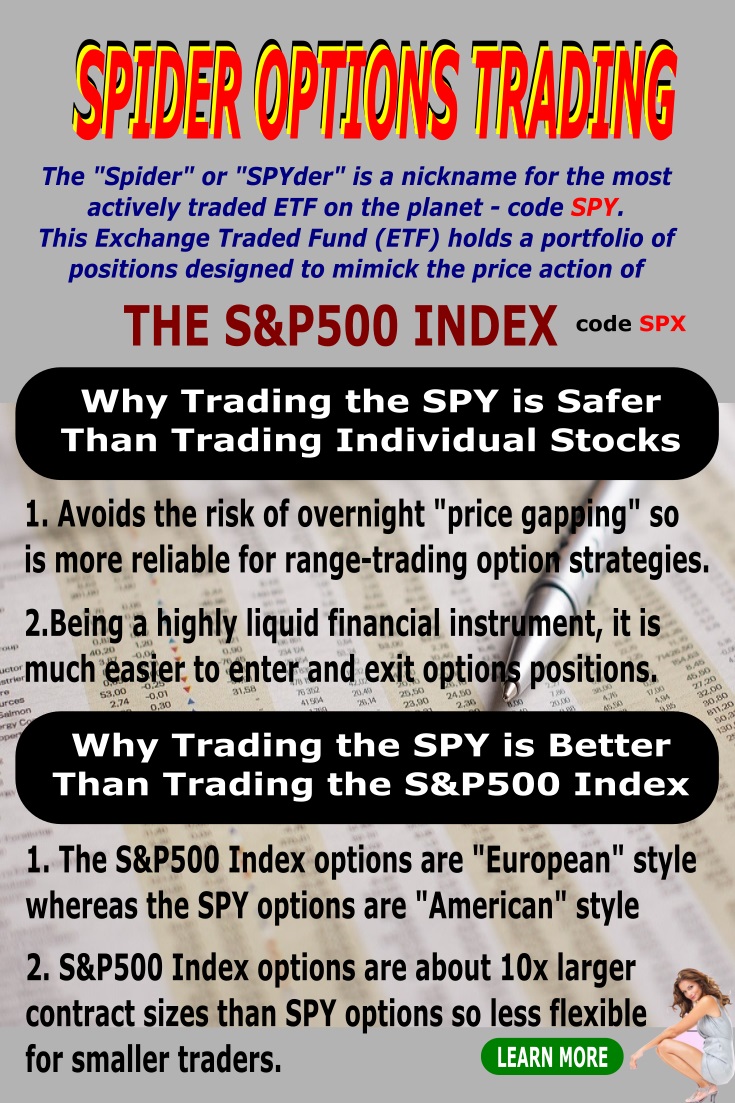

Spider options trading is a term used to describe a trading strategy focussed on option contracts associated with a very popular exchange traded fund (ETF) commonly known as "The Spider" (or Spyder).

This ETF is one of the biggest investment funds in the USA and exists for the purpose of holding a basket of financial instruments that represent the Standard and Poors 500 (S&P 500) selection.

After the Dow Jones Index, the S&P500 is the second most widely followed index because it represents a weighted index of the top 500 actively traded large cap stocks in the USA.

The 'spider' is an ETF that is designed to mimic the price action of this popular index. The stock exchange code for the spider (or spyder) is: SPY.

The name 'spider' is a shortened version of the acronym used to represent the correct name for a family of investment funds known as Standard and Poors Depository Receipts (SPDR). The first member of this family is the SPY.

Other well known exchange traded funds follow other indexes and include the DIA (Diamonds) which follows the Dow Jones Industrial Average, and the QQQ which tracks the NASDAQ100.

Spider options trading is considered a safe alternative to trading options based on individual stocks because it avoids the unexpected price moves that can arise as a result of news items about a particular company.

One stock price in the index may rise or fall dramatically following a news release but it will have little effect on the overall weighted balance of the remaining 499 large cap stocks that make up the index.

Why Spider Option Trading is Safer

If your option trading strategy relies on a more stable and somewhat predictable price fluctuation, taking options positions derived from the SPY as the underlying security is a preferred approach. Since the SPY basically follows the S&P500 large overnight price gaps are very rare.

Apart from major global financial meltdowns like the 1987 stock market correction, or the more recent "global financial crisis" (which only seem to happen every 10 years or so), or even more recently, the early days of the Covid-19 pandemic, the SPY is a trading instrument that can be relied on.

Spider options trading is also a very liquid market which means you should find it easy to enter and exit your positions, however large they are.

A number of option trading strategies have been developed based on the SPY. One in particular, is not only well-known but highly recommended, because it uses double calendar and iron condor spreads to take advantage of option time decay.

Learning the art of adjusting your positions in combination with these strategies brings reliable and consistent returns, providing the trader with a sense of confidence.

If you wish to learn an excellent option trading strategy based on ETF's that follow indexes such as the SPY, the DIA and others, I highly recommend the video series by Tradingology.

I have watched these videos and can assure you that they are very professionally presented and explain all you need to know in great detail. In fact, each one ends with the speaker's characteristic assurance ... "trade with confidence".

Spider Options Trading With Binary Options

Binary Options Trading is a more recent innovation, so much so that it barely resembles the characteristics of traditional, or "vanilla" options. The concept is simple - you predict an outcome for the underlying, if you get it right, you get paid about 70 or more profit, if you don't, you lose 85 percent of the amount you risked. Two simple outcomes - hence, binary.

Binary options are traded over a number of different securities, including currencies, commodities and for our purposes here, indexes. Whilst the binary option contract is not specifically on the SPY, it is on the S&P500 index itself. But the outcome is the same and is worth mentioning here as an alternative approach for those who like to keep things simple.

**************** ****************

Return to Index Options Contents Page

Go to Option Trading Homepage

New! Comments

Have your say about what you just read! Leave me a comment in the box below.