Search Options Trading Mastery:

- Home

- Advanced Strategies

- Short Iron Butterfly

Short Iron Butterfly Option Strategy

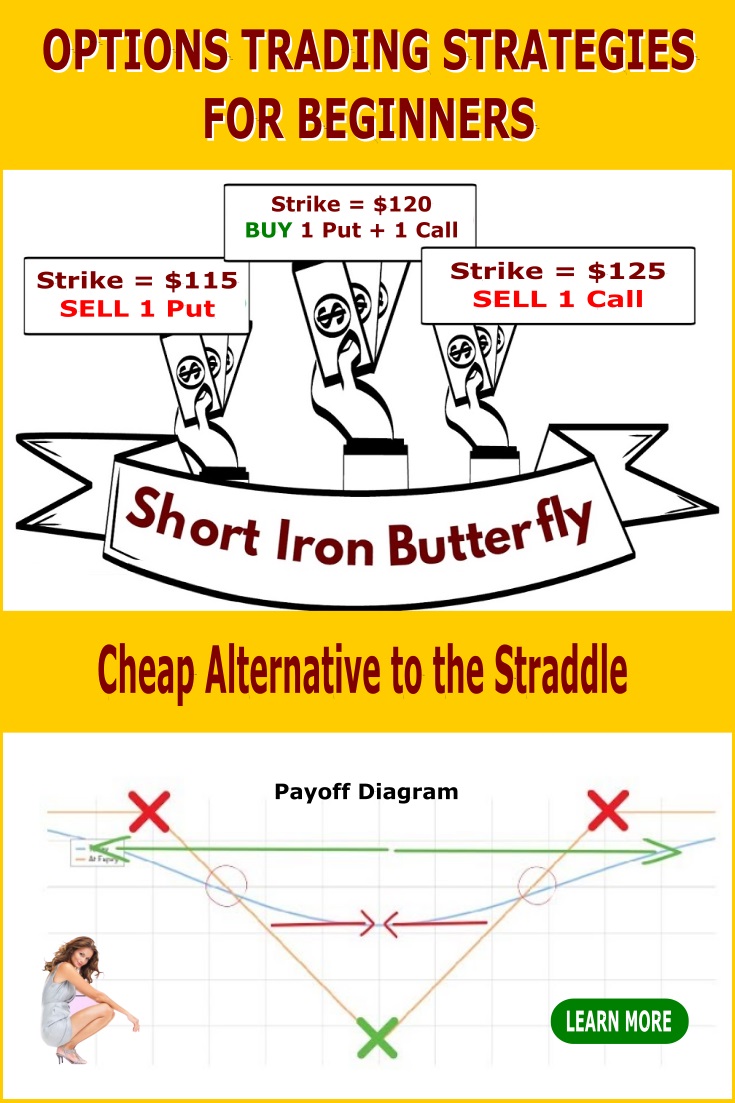

The Short Iron Butterfly - Cheap Alternative to the Straddle

The short iron butterfly strategy is pretty much the exact reverse of the Long Iron Butterfly. In contrast to the latter, where you are anticipating the underlying stock to remain within a trading range as a prerequisite to implementing the strategy, a Short Iron Butterfly can be considered when you believe a price breakout is imminent.

Do NOT use Short Iron Butterflies for range-trading stocks!

Another important consideration is, that this approach is an alternative to a Straddle trade - the only difference being that theoretically a Straddle has unlimited profit potential whereas the Short Iron Butterfly's profit is limited.

However, the Short Iron Butterfly is usually a much cheaper position to enter, due to the 'sold' out-of-the-money positions offsetting the cost.

How to Set Up the Short Iron Butterfly

The basic idea is that you are combining two debit spreads - one with an upward aspect and comprising call options, the other facing downwards and using put options.

- BUY the same number of 'at the money' (ATM) call and put options - in the same way you would for a Straddle.

- SELL the same amount of call and put options, only further 'out of the money' (OTM) on either side of the current market price of the underlying stock - calls above, puts below.

As a result of the above, you will incur a net debit to your account, since ATM options are more expensive than OTM options.

Risk and Reward Profile

As with most options positions, the Short Iron Butterfly has limited risk. In this case, your maximum risk is limited to the net debit, ie. the cost of the position.

The potential profit is also limited to the difference between the strike prices on one side of the trade at option expiration date, less the net debit incurred on entering the position.

You should always construct a risk graph before entering the trade. If the potential maximum profit at expiration date is at least 200 percent and you feel confident the stock is about to make a sharp move in either direction sometime soon, then the Short Iron Butterfly may be an attractive alternative to the Straddle.

Exit Strategies

If the underlying stock falls below the lowest strike price (puts) or rises above the highest strike price (calls) before options expiration then you will be in the profit zone.

If you are confident the stock will not rebound before option expiration date, you can consider closing out one side of the trade while letting the other side expire worthless. This will minimize your brokerage costs on exit.

If the stock remains within the upper and lower breakeven points on your payoff diagram until expiration, you are facing a potential loss. The breakeven points at expiration date will be the highest strike price minus the net debit or lowest strike price plus the net debit on entry.

Because this is a strategy where you are relying on one of the ATM options to make sufficient profit to cover your net initial debit, plus some - and this looks unlikely - you should close out your positions and realize the maximum loss previously mentioned.

Conclusion

In order to make a profit from this strategy, the underlying stock needs to make a significant move, preferably earlier than later. The upside of the deal is that it will be cheaper to enter than the straddle, but you need to take extra brokerage costs into account and decide whether there is an economy of scale here.

The further away you set your outer strike prices, the more likely you are to realize a profit in the event of an early move. But if the premium you receive from your OTM sold options hardly covers the extra brokerage fees then you're better off sticking with a Straddle or Strangle option strategy.

************** **************

Go to Option Trading Strategies contents page

Go to Option Trading Homepage

New! Comments

Have your say about what you just read! Leave me a comment in the box below.