Search Options Trading Mastery:

Option Trading For a Living

Option Trading For a Living - Is it Really That Simple?

The very idea of option trading for a living is appealing in itself. It conjures thoughts of sacking your boss, working (if you can call it that) from home, making a few decisions each day and watching the profits roll in while you enjoy the lifestyle of your dreams.

Anyone ever put it to you like that?

Very appealing isn't it!

But it's not reality.

This doesn't mean that it can't become reality for you - it's just not as simple as some people like to present it ... and they're usually the ones who want to sell you something.

Option Trading For a Living - Make These Decisions First

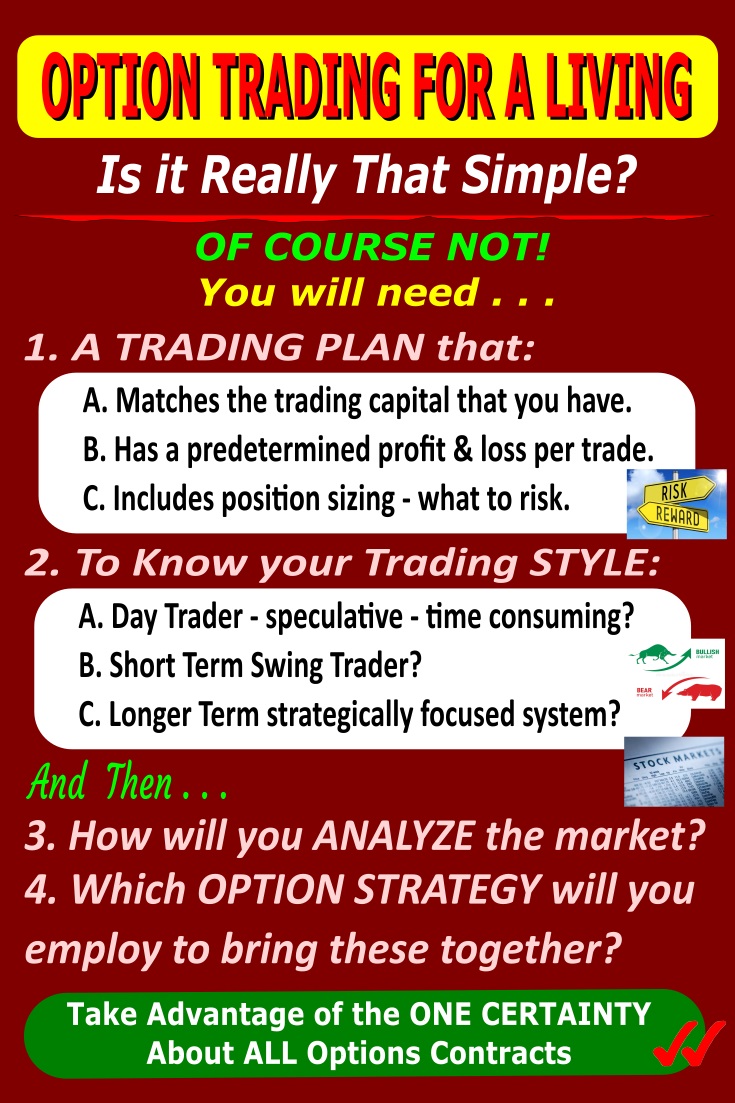

Like anything worthwhile in life, option trading for a living requires a number of essential things.

You need to have a plan, a trading system that matches the amount of trading capital you have. This plan should include a minimum gain per successful trade and a maximum loss per losing trade. It should also include position sizing, i.e. how much, or what percentage of your entire trading capital, you will risk on any one trade.

You also need to decide whether your trading style will be more speculative, such as with day trading, or longer term strategically focused.

You should also know what methods you will regularly use to assess the future price direction of the underlying stock, commodity or index that your options are derived from.

- Will it be a "fundamentalist" approach - based on company reports and management?

- Or will you be a "technical analyst" - looking at charts for price patterns?

- Or perhaps you may choose an options advisory service and trade their recommendations.

How will you match the approach you take with the option trading strategy of your choice?

For example, if you want to be a non-directional straddle trader, your focus might be on upcoming earnings reports, or on forming "symmetrical triangle" patterns in stock charts, along with low option implied volatility.

If speculative trading is more your "thing" then you would be looking for support and resistance levels, drawing trend lines and looking for short term price breakouts using indicators of your choice.

The very term - option trading for a living - implies reliance upon your trading profits as your main, or even sole, source of income. So before you take the plunge, you need to feel supremely confident that you can actually do this; that whatever system you plan to use will work in all market conditions and consistently over the long term.

You need to be committed to ongoing learning, together with continued paper trading to test your strategies. In short, you must develop a passion for option trading.

Matching Starting Capital with Trading Style

If you only have a small amount of capital to begin with, you should quickly dispel any thoughts of option trading for a living ... for now. Keep your job and think of your trading activities as only a means to increase your trading capital base over time. Once you have accumulated at least $10,000 then you're in a position to make some decisions.

If you believe you have a good and tested system (you have tested it, not someone else) and are content to risk no more than 10 percent of your trading capital on any one trade, then it's not unreasonable to conclude that you're ready to give option trading for a living a serious go.

But if you prefer a less risky but also less profitable trading approach, using more conservative option trading methods such as covered calls, you should ideally like to have at least $50,000 at your disposal and aim to return between 5 and 15 percent per month.

An average of 10 percent per month would bring in around $5,000 per month or $60k per annum. This would be option trading for a living.

Alternatively, you could employ some advanced spread trading strategies as outlined in the very popular Trading Pro System series of videos.

With about $10k in starting capital (you may need this so that you can adjust some types of positions when necessary) or less, if you're content to let your capital slowly grow, you can easily return around 40 percent on risk each month.

As your capital grows, you then employ the wealth building strategies that it teaches in Module 11, for long term financial security.

**************** ****************

Return to Explain Option Trading Contents Page

Go to Option Trading Homepage

New! Comments

Have your say about what you just read! Leave me a comment in the box below.