Search Options Trading Mastery:

Option Trading Basics

Some Option Trading Basics That Any Aspiring Trader Needs to Know

Once you become aware of some option trading basics and the many things you can do with options, the world of option trading is suddenly very fascinating indeed!

The beauty of options lies in their flexibility. You can do almost anything with them - and for a fraction of the capital outlay involved with buying and selling actual company shares.

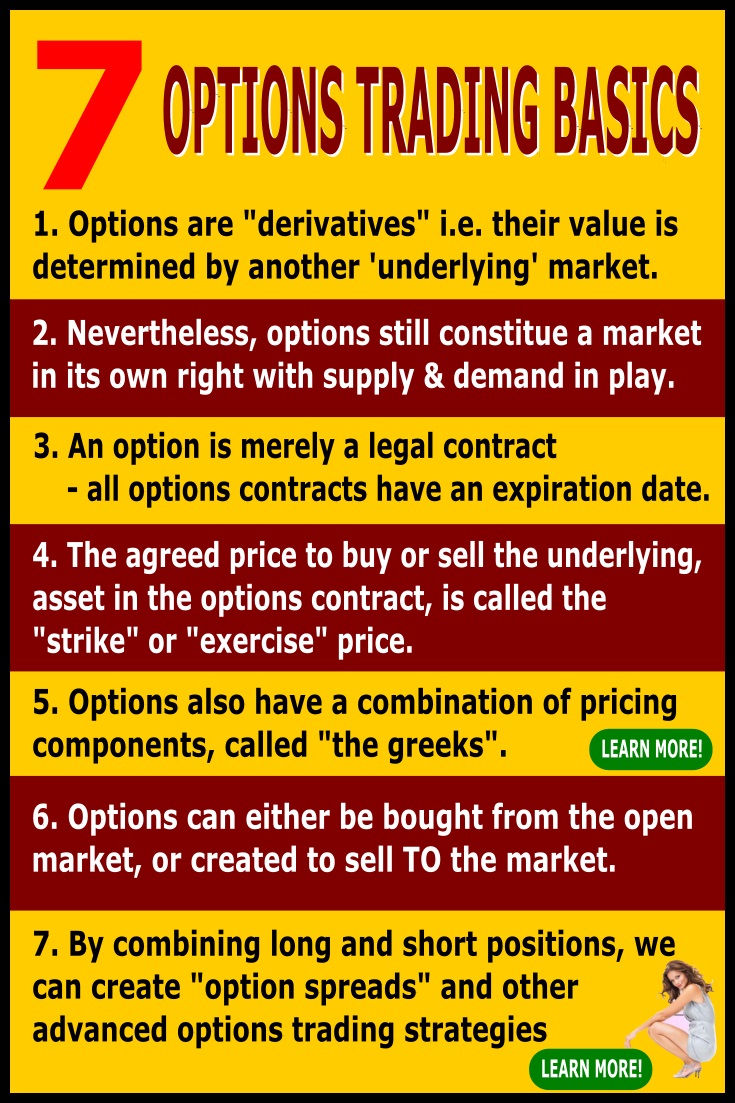

The options market is known as a "derivative" market, because the option price is "derived" from price movements in another market, usually called the "underlying" market.

So if you're looking at stock options, the underlying market is the stock market. But one of the important option trading basics to remember is, that an options market is a market in itself, with its own supply and demand factors in play.

Here are a few interesting option trading basics, which give them their flexibility:

Expiration Date:- number one in your 'option trading basics' list, is that all options contracts expire WORTHLESS on an agreed date IF they are "out of the money" at that time. This factor, adds the element of "time decay" to options. To the buyer of an option, time decay is a bad thing, but to the seller (writer) of an option, it works in your favour.

Strike Price:- this is the agreed price that the underlying market (say, a stock price) must be above (or below, depending on whether it is a call or put option) at any given time up to expiration date, for it to be "in the money" - i.e. have what is called "intrinsic value". This is one of the most important option trading basics you should understand, as it is the key to many option trading strategies.

Implied Volatility:- this is a component of the option price, theoretically based on the anticipated percentage movement in the underlying market price over a given period of time.

So if a stock is expected to move 20% in price over the next 30 days, then the "implied volatilty" in the option price should be around 20%. This "implied volatility" is then compared with the "historical volatility" of the underlying stock price movement, to evaluate whether the option is fairly priced.

Sometimes you get "volatility spikes" or "skews" which can present trading opportunities. Buyers of options usually look for low volatility, whereas sellers would like to see high implied volatility in the option price.

Buy them or Create Them:- this is one of the option trading basics that makes all the difference. Not only can you buy options in the hope of selling for a profit, but you can actually create an option contract out of nothing. This is usually called "writing" or "selling to open" an option contract. The ability to do this opens up a whole world of possibilities.

Here are just a few:

Option Spreads

Option spreads involve the simultaneous buying and selling of an option contract at two different strike prices, with the same expiration dates.

If you buy an option closer to the stock's current market price and sell another one further away from it, you have invested in a debit spread. It is a net debit because the closer the option strike price is to the underlying's current market price, the more expensive it is. The one further away is cheaper, hence a net debit.

However, if you did it the other way around, you would have an option credit spread. You would receive funds into your trading account.

There are many advantages in option credit spreads, including the ability to adjust the position if the underlying price goes against you. The returns are not as good as with debit spreads, but they are much safer.

Credit and debit spreads are known as "vertical spreads" for obvious reasons. However, because you also have the added factor of different "expiration dates" with options, you can use this to create "calendar spreads".

A calendar spread involves buying an option with a strike price closer to the current share price, but with a long expiration date, say, one year out - and then selling (writing) options with a short expiration date, such as only one month out - and for a strike price further away than the bought position.

There are variations of calendar spread expiration month strategies, but if you chose the one above, then as the months roll on, you would keep selling more options with short expiration times. The idea works on the principle that the sum of the parts is greater than the whole.

The total of all your "sold" positions over a year will realize a greater credit, than the debit (cost) of your one original bought position. The debit (bought) position is simply a hedge for the sold ones.

But you also could do a calendar spread with only one month difference in expiration months. As long as the underlying remains within a certain price range until expiration of the sold options, you would profit.

If the price action threatened to break out of the range, you can still profit by simply knowing how to adjust the position.

There are many more variations of the above, all with interesting code names, including ratio backspreads, butterflies, condors, iron condors. Then there are also the "delta neutral" positions such as straddles and strangles ... but these have been explained fully, elsewhere on this site.

**************** ****************

Return to Explain Option Trading contents page

Go to Option Trading Homepage

New! Comments

Have your say about what you just read! Leave me a comment in the box below.