Search Options Trading Mastery:

- Home

- Index Options

- OEX Option Trading

OEX Option Trading

OEX Option Trading Has Some Clear Advantages

Before we launch into the subject of OEX Option Trading, we need to establish a foundation for the subject. The $OEX is the code that represents the Standard & Poors 100 (S&P100) which is an index of the top large cap 100 companies listed on stock exchanges in the United States.

The index covers a range of industries, but is constructed so that larger companies have a greater influence on it. For this reason it is known as a market value, or capitalization weighted index.

You've probably heard of the S&P 500 which is a broader based index of the top 500 US companies. Well the OEX is simply a subset of that. It is a good barometer of the overall mood of the blue chip stocks in the US markets.

OEX option trading is simply about trading a derivative product (options) whose values are based on the price action of the underying $OEX index. It was launched in 1983 as the world's first optionable index and until recent times, has been the most popular index option.

But in recent years its popularity has waned, as other rival products have come onto the market such as the Nasdaq 100 Index Trust, commonly known as the QQQ or the "Q's". The QQQ is currently the most liquid and highly traded index in the world.

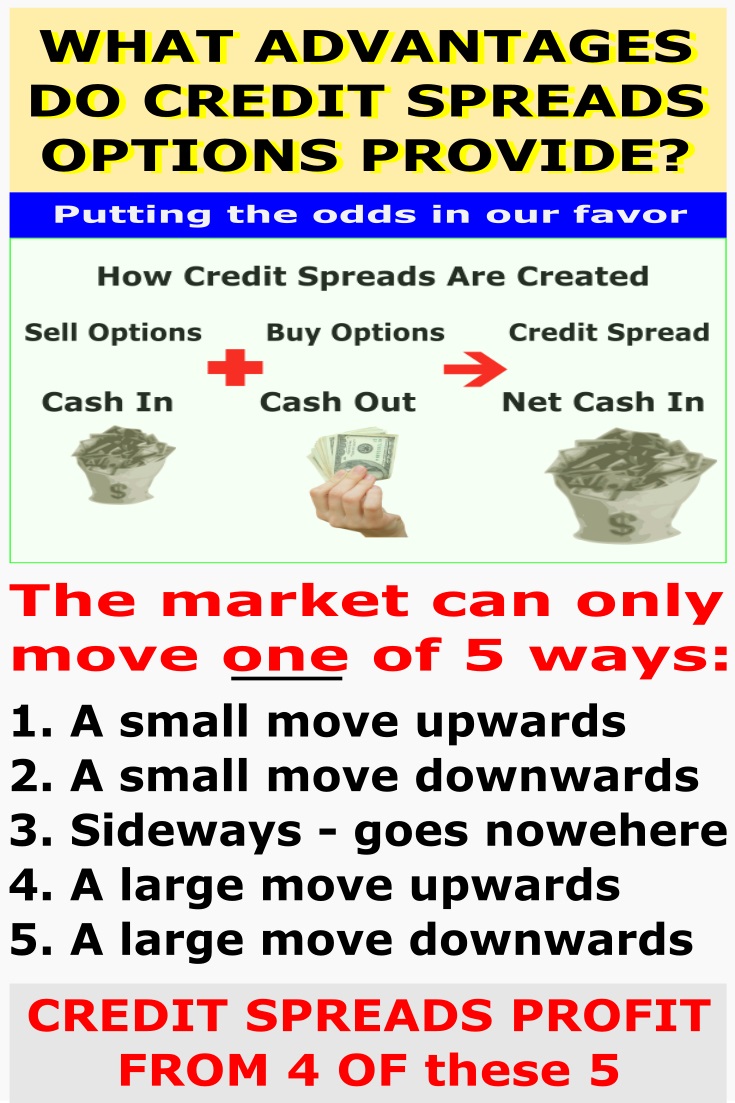

Another use for the OEX over the years has been as a hedging instrument for a portfolio of blue chip stocks. OEX put options have provided valuable protection against falling stock prices for large fund managers. For this reason, OEX put option volume is generally greater than call option volume.

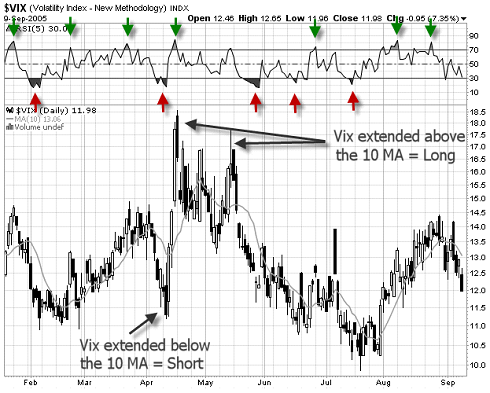

In connection with OEX option trading, a trader should always keep an eye on the VXO - the code for the S&P 100 Volatility Index on the Chicago Board Options Exchange (CBOE). The VXO indicates the level of put options that are being purchased and therefore the likelihood that a rising market is due for a reversal. It works opposite to the OEX in that, when the VXO is rising, the OEX is falling - or is about to.

OEX Option Trading with the OEF

The OEF is the code for an Exchange Traded Fund (ETF) called the iShares S&P 100, whose portfolio of stocks mimics the composition of the S&P 100. As such, it's price action follows its big brother, the larger OEX.

The difference between the OEF and the OEX is that the first, being an ETF, is an actual company stock whereas the second is purely an index. Indexes are cash settled financial instruments, whereas stocks are settled by transfer of the underlying shares. Stocks also include dividend payments whereas indexes don't.

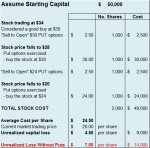

But the OEF is useful in that its option prices are much cheaper than the OEX options and therefore more accessible to traders with a smaller capital base.

The beauty of index option trading in general is that, unlike stocks, they are usually less volatile, because they are an average of a large number of stocks.

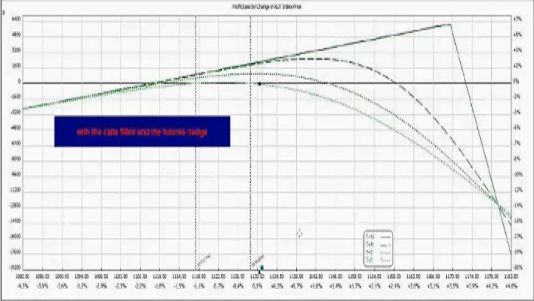

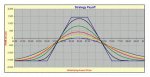

One of the best systems I have found that shows you how to take advantage of index related options, is the Trading Pro System. It is a system that educates you to "trade by the numbers" and focuses on treating your trading as a business whose inventory is a portfolio of options - in particular, index options.

**************** ****************

Return to Index Options Contents Page

Go to Option Trading Homepage

New! Comments

Have your say about what you just read! Leave me a comment in the box below.