<meta name="p:domain_verify" content="a18b2c1f8e33804ac933d39eaa644b90"/>

Search Options Trading Mastery:

- Home

- Advanced Strategies

- Iron Condor Spread

Iron Condor Spread Using Options

The Iron Condor Spread - Make a Killing With This Bird

You might think that iron condor spread is a strange name for an option trading strategy - and indeed it is.

But in a way, the image it presents is well suited to the setup. The condor is a large vulture-like bird.

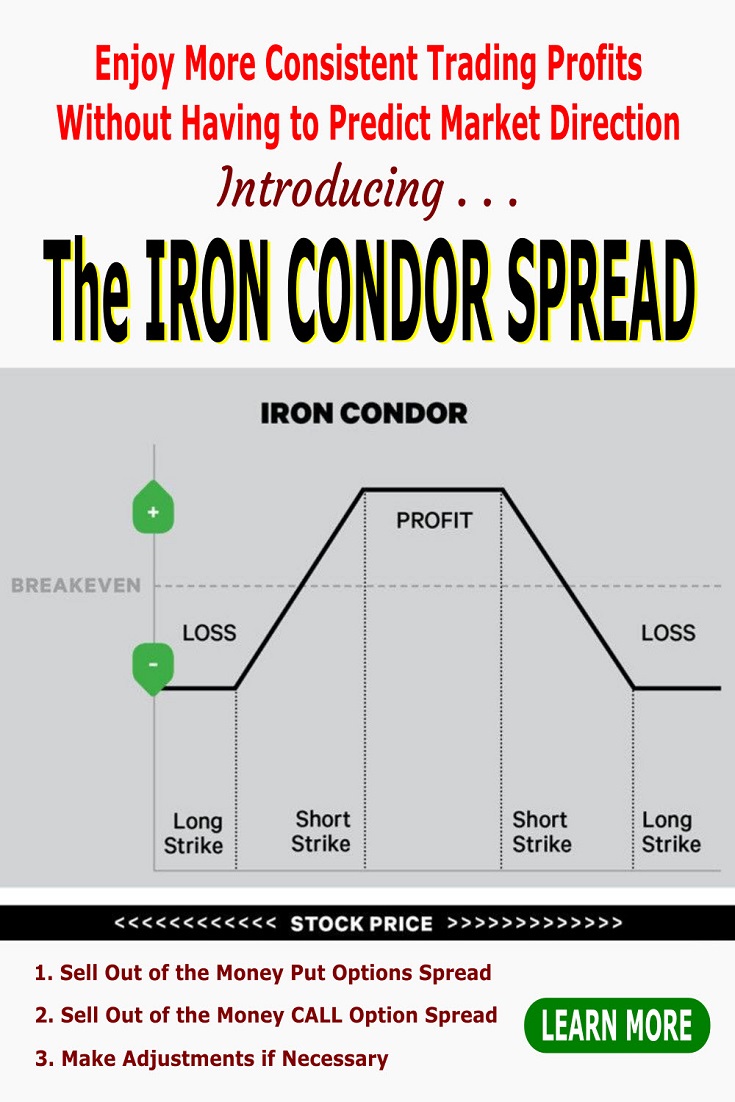

Like any bird, it has a body and wings. The Iron Condor is no different. It is a combination of 4 bought and sold options positions, or putting it another way, two vertical credit spreads separated by a price range.

- The lower credit spread is comprised of put options.

- The upper credit spread is created with call options.

The separating range between the spreads is the "body" of the iron condor, while the credit spreads form the "wings".

The 4 positions work together to form a formidable vehicle for profiting in the markets.

Why?

Because they are adjustable.

What is An Iron Condor Spread?

The two credit spreads that make up the Iron Condor face in opposite directions.

You create a 'bear call spread' and a 'bull put spread'

The bear call spread sells call options with a strike price closer to the current market price of the underlying, and buys the same number of calls at a higher strike, so that the sold calls are not "naked" positions, but hedged.

The bull put spread sells put options closer to the market price of the underlying and buys them at a lower strike price, to hedge the position.

Since both the sold positions will be closer to the money, they are more valuable. The end result is a double net credit to your account from both sides of the trade. This double premium helps to minimize the overall risk.

Theoretically, you are relying on the market price of the underlying stock to remain within an anticipated range for this strategy to be profitable.

But as we shall see later, one of the beautiful things about option credit spreads is that they can be adjusted, which means that ultimately, you have an excellent chance of making a profit whatever happens.

Advantages of The Iron Condor Spread

Because you have established a trade facing both ways, it means that by the expiration date only one of them can possibly lose.

This would only occur if the price of the stock or ETF moved strongly and broke through the outer bought position's strike price on either side.

But the double credit premium works in your favor in this regard.

Not only that, but because only one side can lose, most options brokers will only require collateral in your account to cover the maximum risk from one side of the trade.

This gives you a much better return on risk than a credit spread by itself.

So what if the worst occurs and the stock price does move outside one of the outer boundaries (wings) of your Iron Condor setup?

The maximum loss at expiration date is the difference between the strike prices of the sold and bought options on any one side, multiplied by the number of shares your option contracts cover, less the double credit you received from the sold options.

Notice we have said, "at expiration date".

There is no requirement to hold the position until the options expiration date, but since any credit spread and therefore especially an iron condor, takes advantage of option time decay, you would take this into consideration when deciding whether to take profit or let it run further.

You would normally set up one of these option strategies with a short term to expiration - say 3 to 6 weeks maximum. About 30-40 days to expiration is best.

If the outer boundary has been breached, you can then assess the situation and adjust the position using one of the following alternatives.

1. Rolling out

You close your original losing position and open a new one with the same strike prices, but with the next month expiration date. Since both positions will be 'in the money' you will receive a premium that is larger than what you are losing on the closed trade.

2. Rolling out and up (or down as the case may be)

You close your losing position and open a new one with strike prices further away from the original, thus expanding the wings, and with the next month option expiration date.

Your credit in this case will not be as large as in the first example, but you have now received three premiums from this strategy - and done so AFTER the strong move, so you should still make an overall profit.

The other side (wing) of the iron condor spread which hasn't been breached will simply expire and you keep the premium.

The Best Chart Patterns for an Iron Condor Spread

The best chart patterns are stocks that are basically moving in an identifiable 'channel' pattern. The channel could be sideways or trending, but you can draw a trend line over the tops of the peaks and under the troughs on the chart and see points of support and resistance.

This gives you some idea of the potential range that the underlying is expected to remain within over the next 30-40 days. The chart pattern doesn't have to be a channel. It could be an expanding wedge pattern or a head and shoulder pattern forming at a long term resistance or support level.

Chart patterns to avoid would be triangles or contracting wedges, because these can often precede strong moves and are therefore more suitable to straddle trades, not iron condors.

Another good idea is to view the underlying using a monthly price chart. This will give you an idea what the likely range will be for the upcoming month.

Final Points to Consider

When you set up your iron condor spread, the distance of the strike prices of each credit spread from the current market price of the share will determine the amount of credit you receive.

Further away, there is lower risk that the wings will be breached but also less profit as well.

Make sure you only do this on a stock or ETF with plenty of option liquidity.

If one side goes deep-in-the-money you want to be able to easily adjust it without being at the mercy of market makers.

If you're trading the iron condor spread in the US markets, be sure to consult the VIX index. The implied volatility between the bought and sold options prices should not be more than a certain percentage.

Finally, use some good software to construct a dynamic risk graph so that you can visually see where your positions are in relation to impending expiration dates and current profitability levels.

Sometimes an Iron Condor spread will need adjusting, should the price action of the underlying threaten its boundaries. To do this properly, it is important you understand how the option greeks work - and learn to use them to manage your positions "by the numbers" and adjust them accordingly so that you remain profitable.

One trap that iron condor traders fall into, is that they wait until it's too close to expiration date before exiting the position. By this time, your ability to adjust the trade has been compromised. Better to take less than the maximum profit potential and walk away, than to remain till the very end and end up losing.

If iron condors interest you, read this article about the best time to exit them.

Top traders NEVER try to predict the market - they only manage risk

Make Money in the Market Whatever Happens, Simply by Learning the Art of Adjusting Your Positions

Watch a FREE video about Managing Trades by the Numbers.

More on the Iron Condor Here

OR

****************** ******************

Return to Option Trading Strategies contents page

Go to Option Trading Homepage

New! Comments

Have your say about what you just read! Leave me a comment in the box below.