Search Options Trading Mastery:

How Do Stock Options Work

How do stock options work, you ask? The answer to that is somewhat involved but if you stay with us for a moment, you'll find it most interesting.

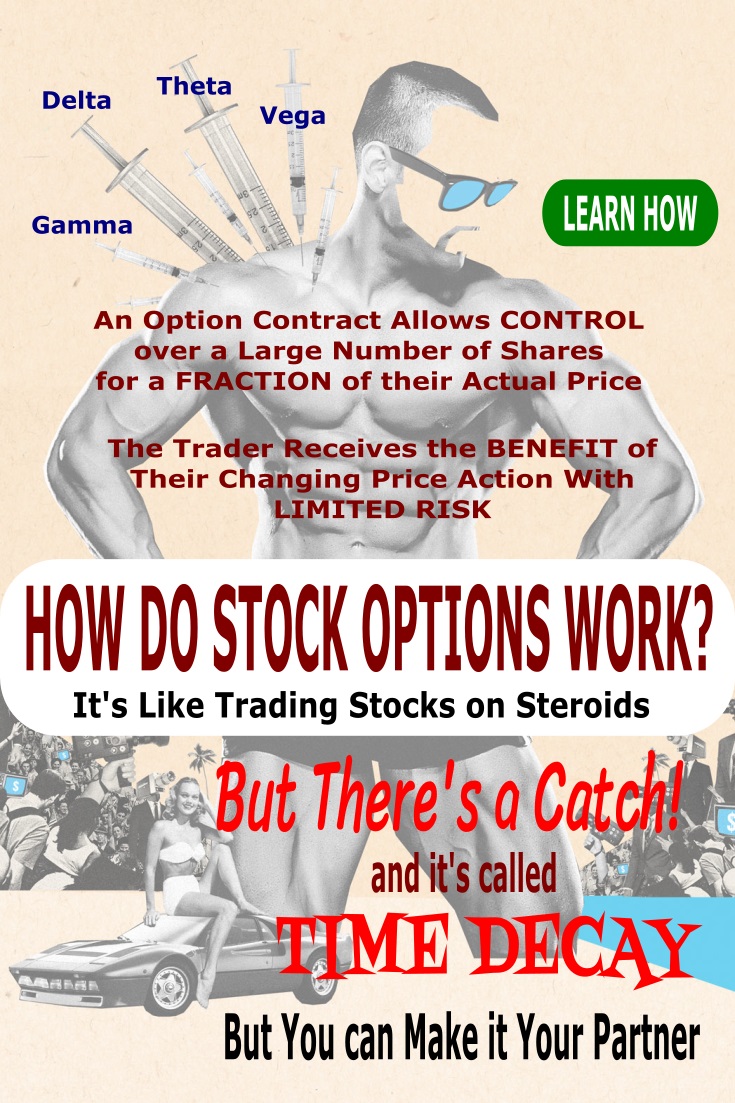

In its simplest form, buying stock options is a way of trading stocks on steroids - but with a catch. The catch is, that unlike company shares, options have an expiration date. This inevitable expiration in turn, significantly affects the changing price of an option contract.

How Do Stock Options Work and What Are Their Advantages?

But how do stock options work in practical terms? Let's break it down.

Think of an option contract as a way of obtaining control over a large number of company shares without actually having to pay the full market price for them, or own them.

However, you get to benefit from the

changing price action of those shares as if you owned them all. This is

called "leverage" - paying a small sum to control the rights to, but

not the obligation to purchase or sell, a large number of shares.

There is a downside to all this. If the price of your chosen stock goes in the opposite direction to what you had anticipated, you lose money - but the amount you lose is not in direct correlation with the changing price of the stock - and will never be greater than the amount you paid for the options.

How Do Stock Options Work Compared to Futures?

- Futures contracts create an obligation but not a right.

- Options contracts create a right but not an obligation.

That is the legal, contractual, difference between the two. Both however, involve the concept of leverage as discussed above.

The value of a futures contract is directly tied to the price of the underlying financial instrument (e.g. stock indexes, commodities, currencies) it is derived from.

It's a 1:1 ratio. - the total value of the stock index covered by the futures contract moves a dollar each way, so does the value of the future - each way.

This makes pricing futures a relatively simple exercise. On the upside they can be the perfect hedge; on the downside your risk is unlimited.

So how do stock options work differently to this? Stock options pricing includes a number of components which have been assigned Greek letters - delta, gamma, theta, vega and rho.

Each of these letters describe a different factor which affects the price of an option in relation to the price of the underlying stock. You can read more about "the greeks" at our page on the option Greeks.

Understanding "the Greeks" gives you an real edge in trading options successfully.

Why?

Because option pricing is not like futures, spot forex, or CFDs - it is much more complex than that. But for the sake of simplicity, we can say that one thing about all options is certain:

They all expire at a set date.

When the options expiration date arrives, they are either "in the money" (ITM), "out of the money" (OTM) or "at the money" (ATM).

- If they are in the money, they have what is called "intrinsic value" - in other words, they are worth something because they give you the right to sell the underlying asset for a profit.

- If out of the money, or at the money, they expire worthless.

How do stock options work in this respect? Let's take an example to clarify.

You purchase a "call option" for company XYZ's shares. The current market price of the stock is $30 but you believe that by expiration date they will be trading at $35.

So you purchase a $30 call option contract. This gives you the right, but not the obligation, to "call" on the market to sell you 100 XYZ shares for $30 each at any time up to expiration date.

If at any time between now and expiration date, the shares are trading above $30, your call options are "in the money" and have "intrinsic value". Why? Because you have the right to buy the stock at $30 and can immediately sell them for more than that.

If trading under $30 they are "out of the money" but if the options have not expired, they will still have some "time value". This "time value" is a measure of the probability that the options WILL be "in the money" at expiration date.

So at one month to expiration, the underlying stock is trading at $28. They are out of the money, because this is less than $30, but the options still carry some "time value" because there is still SOME probability that the shares will be in the money by expiration in one month.

But let's say the above scenario holds true at one week to expiration. Now the probability they will expire in the money is much less and this will be reflected in the current trading price of the options.

But how do stock options work when they are "in the money" (ITM)? Well let's say our XYZ shares (the underlying asset) are trading at $34. Now our $30 call options are $4 in the money. This $4 is the "intrinsic value" of the options.

But built into the option pricing structure is also an element of probability - "time value". So our options must be worth at least $4 at this point, plus some "time value" which reflects the probability that these call options will remain in the money by expiration date.

The closer you get to expiration date, there will more intrinsic value and less time value in, in-the-money options. If the price of the shares has soared up to say, $40, the options are considered to be "deep in the money". The same goes in reverse if they are down to $20.

How do stock options work in a Falling Market?

This is when you would be inclined to purchase put options. Put options allow you to "put" shares of stock to the market at an agreed price, any time up to an agreed expiration date.

The pricing and leveraged structure of put options is exactly the same as for call options, except that the rationale behind it is that, if you have the right to sell (put) stock to the market for $40 when the price has fallen to $35, you make an instant $5 profit.

What we have described above is only a brief answer to the question "how do stock options work?". There is much more to it than this. Option contracts also have this interesting feature - you can create them out of nothing as well as purchase them.

The ability to do this, gives rise to a plethora of option trading strategies - and this is where the fun really begins.

You can combine different "bought" and "sold" positions, with different expiration dates and strike prices, to come up with an almost limitless number of possibilities.

You can even take positions such as straddles and the even more powerful victory spreads, which limit your risk while offering unlimited potential profit.

Combine this with good money management and run it like a serious business - and you could be among the many traders who no longer need to work for someone else but have more than replaced their income and can focus on a lifestyle of choice.

How do stock options work? Let the journey begin . . .

**************** ****************

Return to Stock Option Trading Contents Page

Go to Option Trading Homepage

New! Comments

Have your say about what you just read! Leave me a comment in the box below.