Search Options Trading Mastery:

- Home

- Stock Option Trading

- Dow Jones 30 Stocks Option Trading

Dow Jones 30 Companies Stocks Option Trading

This article is not about trading the Dow Jones index. It is about Dow Jones 30 stocks option trading each of the individual stocks that make up the famous Dow Jones Industrial Average. The advantages of high liquidity and ease of entry and exit make this a very attractive trading model.

If you're an option trader and your main objective is to be able to quickly and efficiently open and close options positions with high 'open interest' and therefore great liquidity, then Dow Jones 30 companies stock option trading might be just right for you.

Dow Jones 30 Stocks Option Trading - Why They Are Ideal for All Option Strategies

The Dow Jones Industrial Index (DJIA) is made up of 30 large corporations based in the USA. They all have options, so all you need to do is find a list of the DOW 30 together with their stock symbols and create a watch list in your charting package or broker account.

Once you have that, simply analyze

these price charts on a daily basis, looking for familiar patterns that

to you, mean trading signals according to whatever criteria you use.

Because the Dow Jones stock are so highly traded, you can not only do straightforward buys of single call and put options, but it is is also much easier to create advanced options positions such as condors, butterfly, calendar and ratio spreads.

These involve a combination of long and short positions which can involve a wide spread of strike prices. The DOW 30 is one place where you shouldn't have any trouble locating "way out of the money" option strikes with a low delta but which still have great open interest.

Some option trading educators adopt the policy that it is a good idea to have a limited number of stocks that you follow anyway. The idea is that you 'get to know' these stocks intimately and become familiar with the way they trade. They become your trading 'friends' and you know which signals are the most reliable for each of them.

Dow Jones 30 stocks option trading on just thirty stocks is a good-sized watch list for anyone, so you should have no problem finding enough trades.

You may even choose to narrow your "friends list" down to the top 10 companies that make up the Dow Jones Index (DJIA).

As at the time of writing, they are:

- Merck & Co.

- Verizon

- Coca-Cola

- Disney

- Home Depot

- Exxon Mobil

- United Health

- Intel

Dow Jones 30 Company Stock Option Trading Strategies

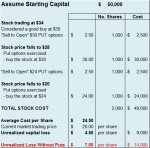

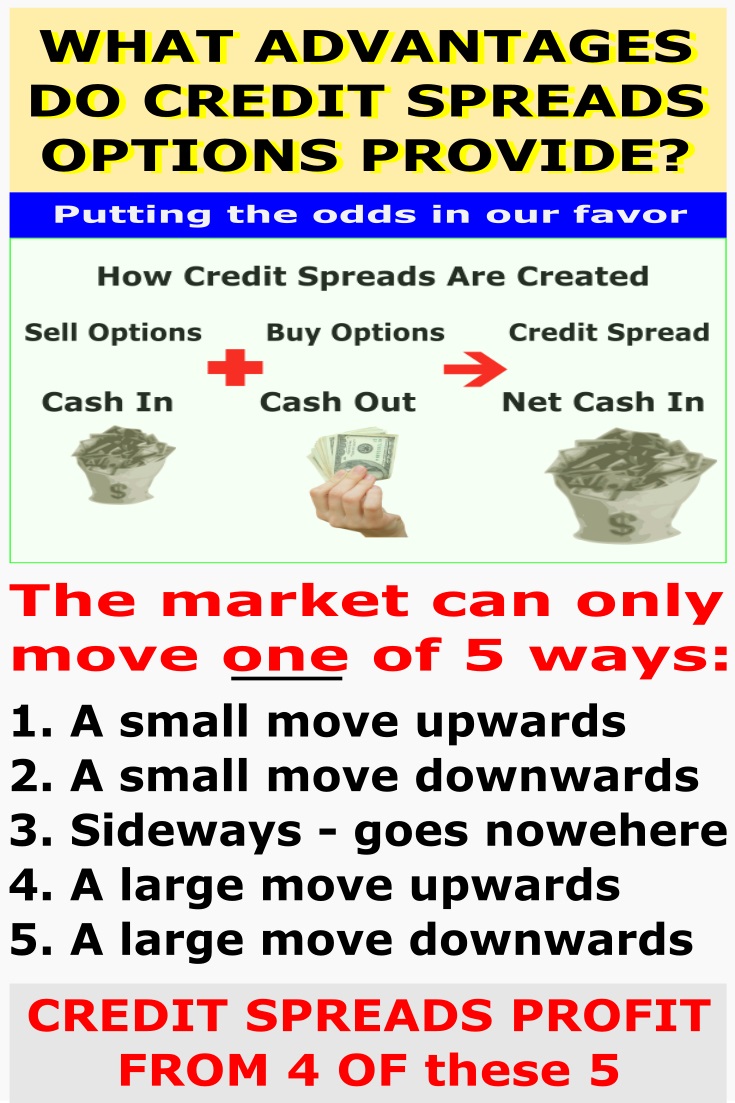

You can also use the Dow 30 company stocks for

- range trading strategies,

- delta neutral strategies,

- vertical spreads,

- calendar spreads and

- ratio spreads.

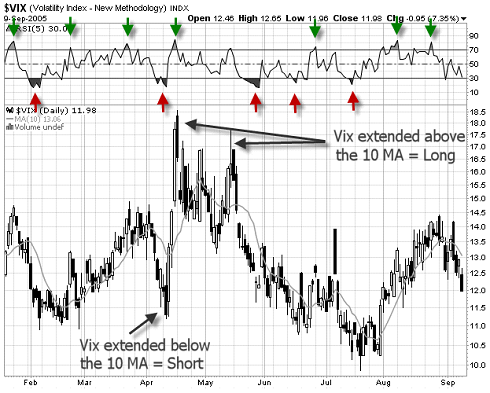

It's important that whatever option software or brokerage platform that you are using to trade these options, has the capability to give you the current implied volatility (IV) in the pricing of the option compared to the historical volatility (HV) of the price action of the underlying stock.

Due to the high ebb and flow of demand for Dow 30 stocks, their option prices can sometimes be over-priced or under-priced. This is critical information that you need to know, particularly if you're considering using spreads or straddles.

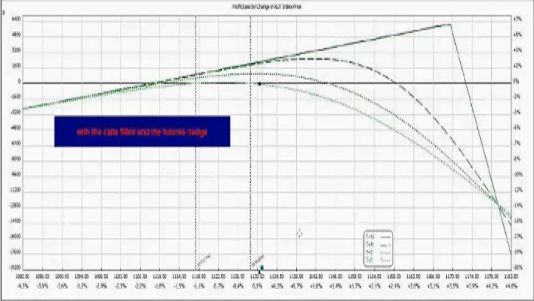

Straddle options should always have low implied volatility and therefore be under-priced. You want them cheap so that if the stock price explodes, the increase in implied volatility in the option premiums that often comes with increased buying or selling volumes will add to your potential profit.

For option spread strategies, you should prefer higher IV on the short (sold) leg of the position compared to the IV for the long (bought) leg. This will give you an edge, particularly if the stock doesn't move in your anticipated direction.

It isn't a problem if the IV is the same, but you definitely want to avoid spreads where the implied volatility in the pricing of the long position is greater than that of the short leg.

The Dow 30 stocks tend to trade in predictable patterns which produce reliable indicators and therefore, can be stocks of choice for better trading results.

If you decide to adopt these large US companies as your "option trading friends", you should look for a reputable broker based in the USA that allows you to easily fund and withdraw from your account, from anywhere in the world, as well as analyze your positions.

Set up your watch list, wait patiently for the right entry signals, stick to your plan, manage your trading capital carefully and there is no reason why you shouldn't realize some consistently positive cashflow.

*************** ***************

Return to Stock Option Trading Contents Page

Go to Option Trading Homepage

New! Comments

Have your say about what you just read! Leave me a comment in the box below.