Search Options Trading Mastery:

- Home

- Covered Calls

- Covered Call Calculator

Covered Call Calculator

A Good Covered Call Calculator Can Make All the Difference

The best covered call calculator will be one that allows you to make informed decisions about your intended positions. It will also enable you to assess the outcomes if you have to roll your positions when threatened.

It should also be able to take into account a number of factors which may influence price movement in the underlying, including earnings release dates and ex-dividend dates. And we shouldn't forget the obvious things such as time premium remaining and the bid/ask spread.

If you're fortunate enough to find a free covered call calculator that automatically updates prices then you have a bonus. But this is a feature you would more like pay for.

Ultimately, your aim is to maximise the premium you receive each month while at the same time, protecting yourself from adverse market moves. My preferred calculator will also assist me to review multiple covered call strategies ... out-of-the-money, at-the-money, in-the-money or when appropriate, deep-in-the-money alternatives should be considered.

You can sometimes get such a calculator included with your broker's platform but these are often very basic.

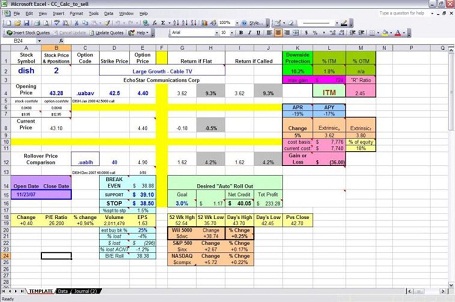

If you would like a more advanced model with better features, then you should consider paying a small sum for a good Covered Call Screener such as the one previewed in the image below.

Alternatively, you could join a premium membership service such as MarketClub where you not only receive this functionality, but other advanced trading tools as well, including a brilliant market scanner for just about any type of options strategy you have in mind (including Covered Calls).

This scanner also comes with a filtering and ranking feature for its findings, plus their famous "Trade Triangles" indicator that identifies trending stocks for simple long options positions or spreads.

You can Test Drive MarketClub for only $1

**************** ****************

Return to Covered Calls Contents Page

Go to Option Trading Homepage

New! Comments

Have your say about what you just read! Leave me a comment in the box below.