Search Options Trading Mastery:

- Home

- Option Spread Trading

- Call Ratio Backspread

Call Ratio Backspread

The call ratio backspread is a bullish options strategy and the reverse of the ratio call spread. Whereas a standard ratio spread seeks to profit from neutral market conditions, backspreads are best suited to a volatile market. What defines them as backspreads, is that you're selling in-the-money calls and purchasing cheaper out-of-the-money calls.

We could summarize the differences this way:

A call spread is a debit spread with equal number of option contracts at each strike price.

A call backspread is simply a credit spread with equal number of option contracts at each strike price.

A call ratio backspread is structured the same way as a credit spread, except that you're buying more OTM options than the ITM options that you're selling. This means that you sell a lesser number of calls at a lower strike price and buy more at a higher strike price.

Below is a typical 1:2 ratio construction example, but you can vary it by trying other ratios such as 2:3 or 3:5 depending on the implied volatility in the option strikes that you're using.

| Call Ratio Backspread Setup |

| Sell 1 ITM Call Buy 2 OTM Calls |

Call Ratio Backspread - Advantages and Disadvantages

The appealing thing about this strategy, is that it involves limited downside risk when compared to just buying calls, but unlimited potential profit to the upside. Placing these trades on strong, uptrending stocks will increase your chances of success.

Another advantage is the cost. Since this is a bullish strategy and your aim should be to put these on for a credit, the cost of entry is less than buying a long call.

If held until expiration date, under a 1:2 ratio a profit will be observed when the trading price of the underlying is greater than or equal to, two times the difference between the strike prices of the short and long calls, plus the net premium received, if applicable.

Because you're relying on a significant move in the price of the underlying in order to profit, the call ratio backspread is best put on using options with about 180 days to expiration.

This gives it time to do its work, as it is unlikely that any stock or ETF will remain within a tight range over a 6 month period. It is for this reason that some have called them "vacation spreads" because you can literally take a holiday and come back later to take a profit.

Breakeven Points

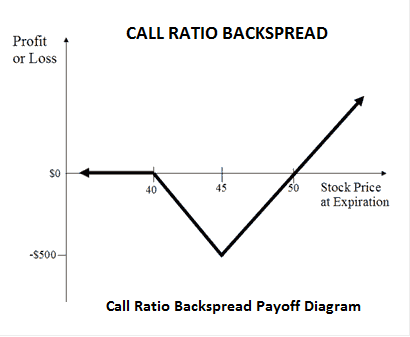

Looking at the risk graph below, you'll notice that there are 2 breakeven points. The upper and lower breakevens (at expiration) are the strike prices of the short and long calls.

Call Ratio Backspread - Example

Let's say we're looking at a chart of a given stock in March and notice that over time, the price has fallen to what we believe is a support level.

We want to take advantage of a potential price reversal at a time when OTM call options have a lower implied volatility than ITM calls. The current stock price is $43 but we believe that within 6 months, it could easily return to it's previous high of $60.

So here's what we do:

1. Sell 1 ITM October calls with $40 strike

2. Buy 2 OTM October calls with $45 strike

The position is entered for zero cost.

Looking at our payoff diagram below, the following scenarios then apply.

Let's say that at expiration date in October (7 months away) the stock price hasn't done much and is now trading at $45. The $40 sold calls will be $5 in the money while the $45 calls will be at the money.

In this scenario, we realize our maximum loss of $500. If we were able to realize an initial credit upon entry due to a reverse volatility skew, this credit would offset the maximum loss.

However, should the stock rally to $50 at expiration date, all options positions will be in the money. The $40 options will have $10 intrinsic value while the $45 options will have $5 intrinsic value. Since we own twice as many $45 options as we sold, we will break even. If we received a credit upon entry, we will take a small profit.

Beyond the $50 mark, our position begins to make a profit. So if we reached our target of $60 in 7 months time, our profit will be $1,000 less commissions, plus any intial credit received, if applicable.

But what if the stock price should continue falling? Should this happen, we will suffer no loss because it cost us nothing to enter the position. Using varying ratios, particularly a 0.67 ratio (Sell 2: Buy 3), we can usually bring in an initial credit so that should the stock price move south instead of north, we will actually make a small profit, being our initial credit.

This is where the call ratio backspread is superior to buying simple long call positions if we have a bullish view.

**************** ****************

Return to Option Spread Trading Contents Page

Go to Option Trading Homepage

New! Comments

Have your say about what you just read! Leave me a comment in the box below.