Search Options Trading Mastery:

- Home

- Option Spread Trading

- Call Calendar Spread

The Call Calendar Spread Options Strategy

The call calendar spread, sometimes called the bull calendar spread, is an options spread strategy that is most suited to market conditions where you believe the underlying financial instrument is due to rise within the short term, but not by too much.

Over the longer term however, the options trader is bullish on the underlying.

Here's how the call calendar spread is constructed:

- Sell 1 Out-of-the-money (OTM) call option with near term expiration

- Buy 1 Out-of-the-money (OTM) call options with longer term expiration

The idea is to reduce your entry price by selling the shorter term options and with the intention of riding the longer term call options for profit.

For this strategy to work, you don't want the price action of the underlying to spike upwards before the short term options expire. These days, with weekly options, you can come up with all sorts of interesting combinations of expiration dates to make this work for you.

Your intention is also to take advantage of accelerating time decay on the OTM short options, as expiration approaches.

Expiration months on the call calendar spread can be anything from one month apart to whatever distance into the future you wish you place your bought options.

Some people are happy to close both positions for a small profit at expiration of the short options, while others would rather ride the long option into potentially larger profits over time. It all depends on your long term view of where the price of the underlying is expected to be.

Call Calendar Spread Example

In this hypothetical example, we're looking at trading options on the QQQ in an imaginary situation where we believe that it will continue to rise over the next few months.

So with the QQQ trading at $106 we decide to sell (short) the nearest OTM options at $107 expiring in 20 days, while at the same time, purchasing $107 call options expiring in 50 days. The total cost is $0.69 per spread position and since we've taken 10 positions, the total debit is $690 plus commissions.

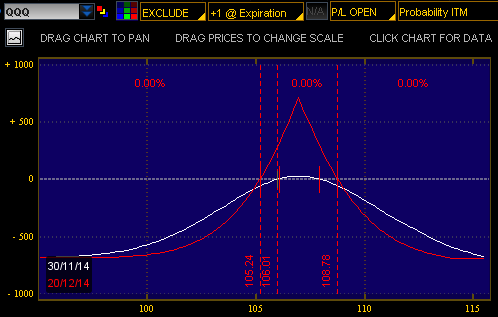

Now take a look at the image below, where we've analyzed the risk graph.

You'll notice that if the QQQ doesn't rise above $108.78 before the near month expiration date, then a profit will be realized if both positions are closed simultaneously.

But if the QQQ's fall below $105.24 we begin to realize a loss, which falls away up until a maximum of the $690 cost of the debit spread. So this is definitely a calendar spread with a bullish outlook.

The maximum profit of $711 is realized if the underlying is sitting at the option strike price of $107 at expiration date.

Things to Look Out For

Before entering a call calendar spread position, make sure you check that there is not too much of a discrepancy between the option implied volatilty of the near term options compared to the longer term ones. If the longer term options are too over-priced, the deal may not be as sweet as you imagine.

Since this position is a debit spread, there will be no margin requirement with your broker. Margin requirements only come with positions where you receive a net credit upon entry.

Experiment With Strike Prices

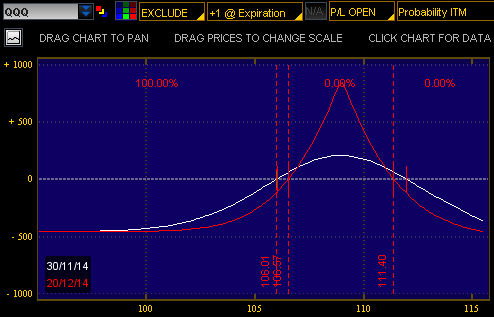

In the second example below, we have taken a different approach. Instead of using $107 calls, we have chosen to go for $109 call options, which are further out of the money. So now our risk graph looks different - and our risk to reward ratio has also changed.

This time, our position has only cost us $460 instead of $690, so that is our total risk. Our maximum profit on the other hand, has risen to $849, which is almost double our maximum risk.

However, we need to believe more strongly that the price of the QQQ will rise in the near term because, unlike the $107 calendar position, there is no room for a fall in price before we start losing money.

Our upper level breakeven point however, has risen to $111.40.

Consequently, the further out of the money your call options are, the more it approximates a simple long call option position with a later expiration date, except that the entry price is reduced and the upside profit potential is also capped.

This sounds like a bull call spread, except that if the price rises too much, too quickly, you begin to see a loss.

**************** ****************

Return to Option Spread Trading Contents Page

Go to Option Trading Homepage

New! Comments

Have your say about what you just read! Leave me a comment in the box below.