Search Options Trading Mastery:

- Home

- Advanced Strategies

- Backspread Option Strategy

Backspread Option Strategy

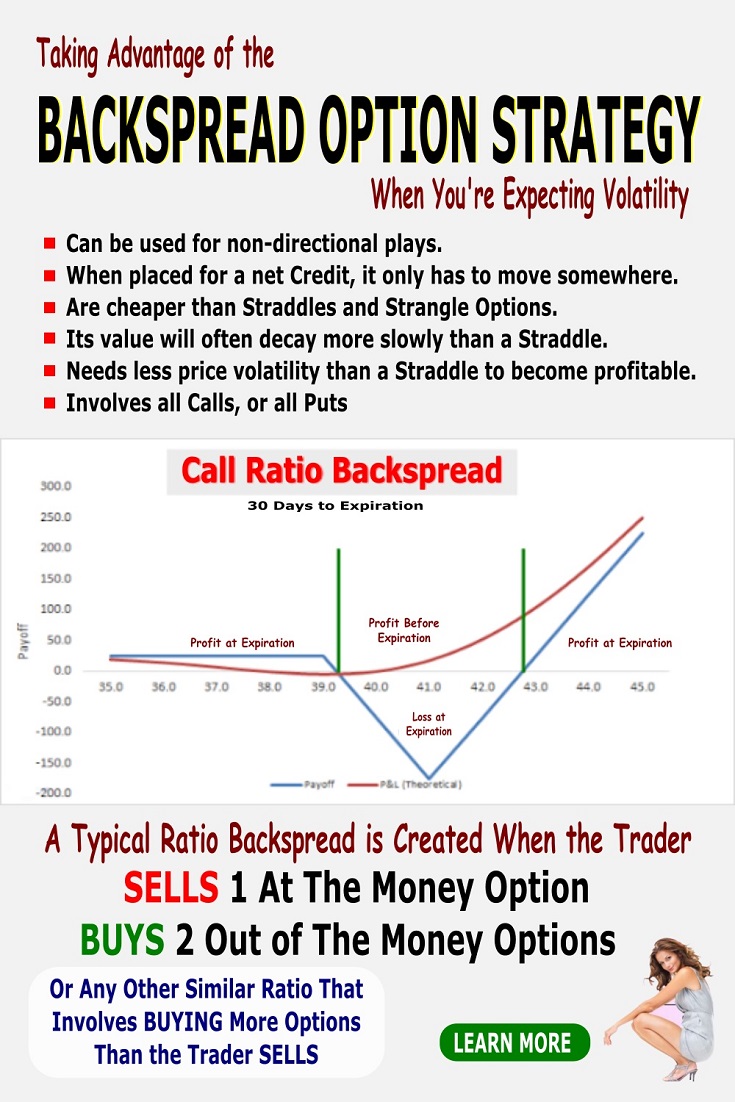

The Backspread option strategy covers a number of setups, all designed to profit from volatile market conditions. Backspreads are a great alternative to non-directional strategies such as the Straddle and Strangle, because they are cheaper to put on.

Unlike the Straddle and Strangle, which can realize potentially unlimited profit in both directions, a Backspread’s profit is unlimited on one side only, and limited on the other side.

Here are some other characteristics of the Backspread:

- A Backspread will cost less than a Straddle and can often be done for a credit.

- A Backspread will normally decay more slowly than a straddle

- A Backspread needs less price movement than a Straddle to move into profitable territory.

- A Backspread is generally less sensitive to changes in Implied Volatility than a Straddle.

- A Backspread wins a smaller percentage of its cost than a Straddle, if you get it right.

- A Backspread involves either all puts, or all calls (unlike the Straddle which involves both)

Profits for Put Backspreads are unlimited to the downside and limited to the upside, while profits for Call Backspreads are limited to the downside and unlimited to the upside.

A Backspread option strategy is like a credit spread in that, where you sell options whose strike price is closer to the current market price of the underlying and buy options whose strike price is further "out of the money".

The difference however, is that with Backspreads, you sell less positions than you buy. You do this because the options that are closer to the money will be more expensive than those further away from it, so you don't need to sell as many as you buy in order to still realize a net credit, or a small debit.

Because of this unequal number of bought and sold positions, it is often called a Ratio Backspread, or Reverse Ratio Spread.

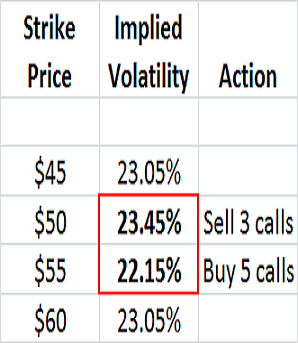

The Backspread option strategy works best where the implied volatility in the short (sold) options positions is greater than the implied volatility for the long (bought) positions.

Back spreads are the opposite of Front spreads. For definition purposes, the simple rule to remember is, that when you buy more options in a spread than you sell, it is called a Backspread. When you sell more options than you buy, it is called a Frontspread. When you buy and sell the same amount, it is just simply a "spread".

Frontspreads can be used very effectively to accelerate profits on share purchases with no extra cost. For information on how to do this, visit the front spreads page.

Backspread Option Strategy - Taking Advantage of Volatility

The best time to get into a Backspread is when you expect the price action in the underlying asset to become volatile in the near future. Fortunately, this is often highly predictable.

The ideal circumstances under which to create a Backspread is when the implied volatility (IV) in the out of the money long (bought) positions is lower than the IV in the closer to the money short (sold) positions.

As implied volatility in the bought options increases, which often occurs when the underlying begins to move rapidly, your positions will show a profit. In most cases, the profit potential is unlimited because you have more long positions than short ones.

There are many factors which can trigger volatility in price action.

These include: Upcoming earnings reports, news releases, court rulings, executive management changes and other business or economic events can affect the price of a stock.

Some of these are predictable, others aren't. Applying a backspread option strategy shortly before such an event that may trigger price volatility, can produce wonderful profits.

Risks in the Backspread Option Strategy

Should the price action of underlying asset remain stagnant for a period of time, the value of your Backspread will deteriorate. It is rare for stocks and commodity futures prices to remain stagnant for extended periods, but it does happen.

If you're using this strategy, you should first be aware of the maximum loss versus potential rewards. Fortunately, maximum potential losses can be precisely calculated for any Backspread option strategy you choose.

Pharmaceutical companies are often a good choice for the Backspread strategy, particularly if a ruling is about to be made about the approval or otherwise of a new drug because this can cause the price of the stock to surge one way or the other.

With limited or potentially no risk to one side and unlimited risk to the other side of a price move, the Backspread Option Strategy when applied under the right circumstances, can be your best friend.

**************** ****************

Return to Option Trading Strategies Contents Page

Go to Option Trading Homepage

New! Comments

Have your say about what you just read! Leave me a comment in the box below.