Search Options Trading Mastery:

- Home

- Advanced Strategies

- Option Volatility

Option Volatility and Pricing Strategies

Option Volatility - A Powerful Indicator in Trading

The concept of option volatility is one of the most little understood and under utilised in option trading. But knowing about it can make all the difference to the profitability or otherwise, of your trading decisions.

It should also be very influential in the type of trades that you decide to put on.

What is Option Volatility?

Volatility, as the name implies, is a measure of the range in which a stock price is expected to travel during a given timeframe. Sometimes stock prices appear to hover within a tight range for a while, in which case you would say that the short term volatility is low.

But then a price breakout comes and a strong directional movement occurs, at which time you would say that volatility has increased.

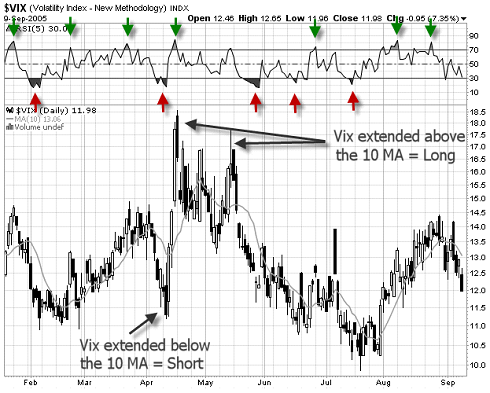

The trick is to determine whether there is any correlation between the price volatility of the underlying financial instrument over a given period, known as the "Historical Volatility" (HV) and the option volatility that is implied in its associated option prices. Where a disparity occurs, it often presents trading opportunities.

Implied Volatility

Essentially, before we place an option trade we need to decide whether the option contract we're looking at is over-priced or under-priced - and the way we do this is by analyzing what is known as the "Implied Volatility" in the option price - the option volatility number.

If we decide that the option is going for a bargain because the Implied Volatility (IV) is low, then it presents a great buying opportunity.

On the other hand, if the option is considered expensive we would probably avoid going long and look at option trading strategies such as spreads involving "sell to open" positions.

Unlike futures, CFDs and spot forex, option prices are more complicated affairs. You may have heard of the Black-Scholes or the American Binomial option pricing models. These are mathematical formulas which take into account the current market price of the underlying stock in relation to a relevant option strike (sometimes called 'exercise') price, plus the number of days to option expiration date, in order to calculate a theoretical price for the option contract.

If the current bid-ask price of the option is above the theoretical price then we would say its Option Implied Volatility is high. Conversely, if the price is below the theoretical price then the IV is low.

Implied Volatility thus becomes two things.

- A premium or discount above or below the theoretical fair value of the option.

- An indicator of anticipated future price volatility of the underlying stock, usually determined by the market maker.

Historical Volatility

The other factor that must be borne in mind in order to give the IV some meaning, is the Historical Volatility (HV) of the underlying stock itself. Both the HV of the stock and the IV of the option are expressed as a percentage and should be compared before entering a trade.

Historical Volatility is basically a stock's price movement either side of an average over a predetermined number of historical trading days.

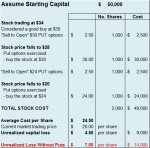

Let's say you're looking at a stock in an upward trend and want to take a call option position following a pullback. You would have a choice of "in the money" (ITM), "at the money" (ATM) or "out of the money" (OTM) strike prices.

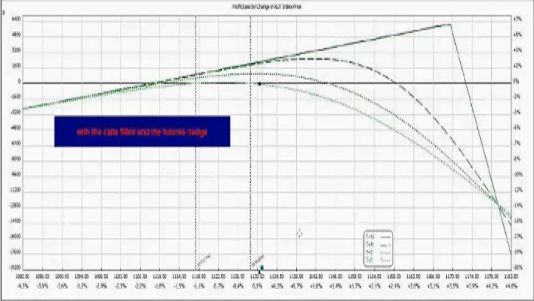

As you compare the call option prices for each strike price, you may notice that the OTM options are over-priced compared to the ATM prices. This is due to option volatility in addition to the reasonable 'time value' left in the option price.

This being the case, you would not want to be buying the OTM options, even though they may appear a little cheaper. You should either 'buy to open' the ATM options or even take out a Bull Call Spread because the OTM sold options would give you a greater credit and make your overall position cheaper, thus giving you an advantage.

How to Use Option Volatility

So why is Implied Volatility so crucial for the options trader? One reason is, because as a rule, the price of an option will always revert to its fair value over its remaining life.

This means that, if you 'buy to open' an option when its IV is too high, then even if the price of the underlying stock goes as you anticipated, the option price itself may not increase in value.

In fact, it is not uncommon for such a setup to result in favorable stock price movement but loss on the option trade, because the option has retreated back to its fair value.

So, for example, if you were to buy a 30 day option that was 20% overpriced - it would depreciate 20% over the next 30 days - possibly more - depending on movements in volatility of the underlying.

But the reverse is also true. If you buy an option at a bargain because its option volatility factor is low, you might even make a profit if the underlying price movement is slightly unfavorable. And if the stock price movement is favorable, your profit can be spectacular.

Here are two simple rules to remember when assessing whether an option is a good buy.

1. The 20 day and 50 day HV of the stock are both less than its 90 day Historical Value. The ideal long option trade would be where the 20 day is lower than the 50, which is less than the 90. This is not essential but it means that the stock volatility in the short term is likely to trend toward the longer term volatility.

2. Compare the 20 day HV of the stock with the Implied Volatility in the current price of the option. If option volatility (IV) is less than the stock HV, it is a good buy.

Conclusion

Option Volatility is one key factor that distinguishes options from other derivatives. Although, like other derivatives, option prices are derived from an underlying market such as stocks, currencies or commodities, the supply and demand for these instruments comes from a standalone market. As such, they are subject to the laws of supply and demand and this means that prices will reflect that.

Implied Volatility in option prices is the magic number that indicates this. Knowing how to use it to your advantage could be one of the most important areas of your trading education.

******************* *******************

Return to Option Trading Strategies Contents Page

Go to Option Trading Homepage

New! Comments

Have your say about what you just read! Leave me a comment in the box below.