Search Options Trading Mastery:

- Home

- Explain Option Trading

- Learning Option Trading

Learning Option Trading for Beginners

By Learning Option Trading You Can Profit Whether the Market Goes Up or Down

Learning option trading means understanding what options are and how you can use them to enjoy consistent monthly profits.

Options are commonly known as "derivatives" because the changing value in options contracts are "derived" from the price action in another underlying market.

Options trading contracts are most commonly associated with companies listed on the stock market and their associated indexes; but you can also have options on commodity futures such as gold, silver, sugar, wheat or pork bellies, or on other financial instruments such as currencies.

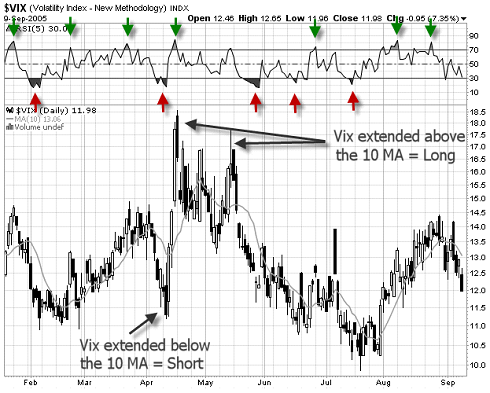

Whether we are talking about company shares, indexes, commodities or currencies, the upward or downward price trends can be analyzed on charts. It is a true saying that "a picture paints a thousand words" and in the same way, charts can give us a visual representation of the movements in price, in a way that no amount of tabulated data can.

Charts are our best friend if learning option trading is our goal, because they help us to decide when to buy or sell, or what strategy to employ.

What is an Option?

Learning option trading for beginners starts with understanding exactly what an 'option' is. It is a contract between two parties to exchange an asset for an agreed price, by an agreed time, called an "expiration date".

If you buy an option, you are outlaying a much smaller sum than you would for the full purchase price of the asset that the option covers. For example, you may have heard of someone having an option to buy land.

In this case, you would pay a few thousand dollars to give you the right to purchase real estate worth over a hundred thousand dollars, for an agreed amount and within a given time frame.

The person who buys an option contract now has a legal right, but not an obligation to buy the 'underlying' asset by a given time.You can exercise that right if you wish, or you can let it lapse, or expire.

Call Options

The same principle applies to options on shares. When you buy a CALL option, it gives you the right to "call" on the owner of the asset, to sell it (or them) to you at the agreed "strike price" up to an agreed expiration date.

Learning option trading involves relating the theory to financial market examples, so let's look at one.

If you purchased a $30 October "ABC Bank" call option, you now have the right (but not the obligation) to purchase ABC Bank shares for $30 up until the contract expires date in October.

Now, imagine that at any time before the option expiration date, the daily market value of ABC Bank shares rose to $32. This would effectively mean that you now have the right to purchase something for $30 and then immediately turn around and sell it on the open market for $32, thus realizing a profit of $2 per share.

If you had purchased contracts that covered 1,000 shares, you have an immediate profit of $2,000, less the cost of the options, at the time the option expires. It shouldn’t be difficult to see then, that the higher the share’s market value goes before the expiration date, the more valuable your call option will become.

As long as the market price is above the option strike price, the call option contract is said to be "in the money" because it now has intrinsic value, not just theoretical, or 'time' value.

If you're intent on learning option trading, it is critical you understand this simple concept.

Put Options

On the other hand, you might think the traded price of a company share is going to fall. You may want to ensure that you can still sell your shares for at least what you paid for them, or slightly below. So you take out a form of 'insurance' called a "put" option.

A put option gives you the right, but not the obligation, to sell (or put) your shares to someone else, for an agreed amount, by a given date.

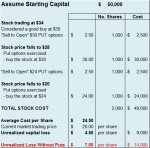

Let’s take our ABC Bank example above and imagine that you owned 1,000 shares that you purchased for $30 but before our October expiry date, the share price plummeted to only $26.

Normally, you would be looking at an unrealized loss of $4,000 (1,000 shares x $4 loss in share value). But if you had also purchased $30 October put options, you have the right to sell (put) the shares back to the market for the agreed price of $30.

For a small cost, you have avoided a $4,000 capital loss - so you would feel like you’ve taken out "stock insurance" which is what a put option really is.

So again, it becomes evident that as the price of a share drops, a put option becomes more valuable. As long as the market price is below the option strike price, the put option contract is said to be "in the money".

After learning option trading, you're happy to realize that you can also profit from options when the underlying market is falling.

Why Choose Options Over Other Derivatives?

Options have often been perceived as high risk and indeed, can be, because their price can rise or fall rapidly as the "underlying" share price moves. If we want to learn option trading it is imperative we avoid the traps.

If we learn how we can harness and tame this power, our perception of options as a trading vehicle can change dramatically.

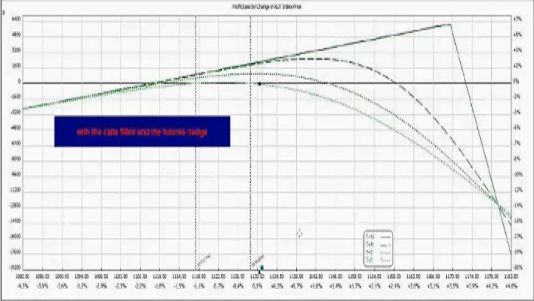

Options, if used wisely, can actually be far less risky than simply trading shares alone. Why? Because options pricing models contain the elements of time (to expiration), probability of intrinsic value and price (movements).

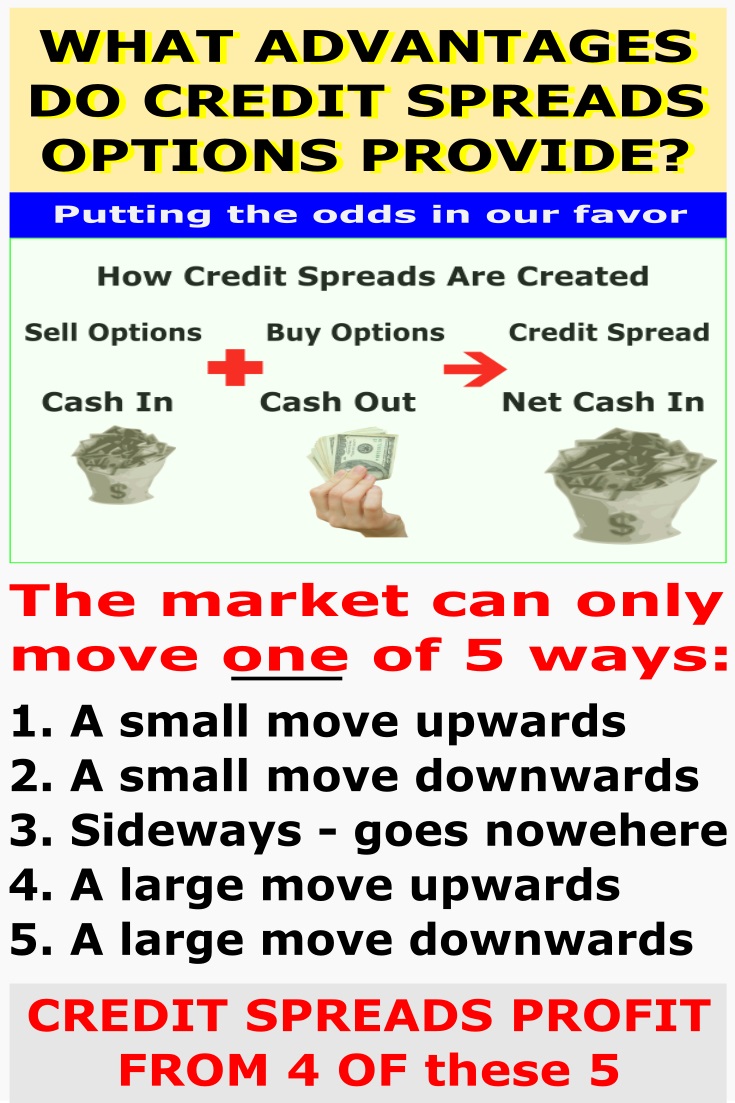

Because options are not assets in themselves but only legal contracts with respect to assets, you can also either buy them or create them out of nothing, to sell them to the market.

When these three elements are understood and effectively combined, they provide a wonderful flexibility that allows us to protect our trading positions, while at the same time, providing opportunity for the same profit that would ordinarily have come from ten times the investment capital needed to produce a return from investing in the underlying shares. This is called "leverage" - less dollars to produce the same profit.

If you can invest a much smaller amount to produce a better profit, this leaves your other capital free for other option investments, bringing even more profit.

You can implement some great option trading strategies with surprisingly little capital and receive excellent returns. Learning option trading is best done the safe way! It's not rocket science. Just buying a simple call or put option with the hope of selling it for a profit can be your express route to financial ruin.

With a little more education, you would be surprised how much better you can do, with much less stress and with the same trading capital.

One of the safest ways for learning option trading

is by understanding The Art of Adjustments. This is about how to fix losing trades by either changing the parameters of the trade or adding to existing positions.

The Trading Pro System shows you how to approach option trading as a real business. Once you know what you do, you have a beautiful, low risk, low maintenance, flexible strategy which enables you to trade with confidence. For more on this CLICK HERE.

*************** ***************

Return to the Explain Option Trading contents page

Go to the Option Trading homepage

New! Comments

Have your say about what you just read! Leave me a comment in the box below.