Search Options Trading Mastery:

Covered Call Writing

Covered Call Writing - A Cheaper Safer Way to Do It

Covered Call Writing is regarded as one of the safest option trading strategies. The way it is normally presented is, that you purchase the underlying shares and then sell call options on them. You can sell them out-of-the-money, at-the-money or even in-the-money, each with different outcomes, depending on current market conditions and expectation.

Purchasing the underlying shares requires a sizeable amount of capital. If the current stock price is say, $40 then it would cost you $4,000 to purchase 100 shares in the USA so that you could write just one call option contract over it. If you wanted to write 10 contracts, the underlying shares would cost you $40,000. Not everyone has that much to risk on just one trade.

But what if there was a much cheaper way to achieve exactly the same effect as a covered call, but for a fraction of the cost. Would a covered call writing strategy like this interest you?

Here is how to do it:

Instead of purchasing the shares themselves, you buy deep-in-the-money call options with at least one year till expiration date. These are called "leap options". By deep-in-the-money we mean the strike price of the options should be more than 10 percent of the share price in-the-money. So in the case of our present example, if the underlying share price is trading at $40 then we would want to buy call options at least $4 in-the-money, i.e. with a strike price of $36 or less.

Covered Call Writing worked example

We have noticed a stock fall to around $40 recently accompanied by heavy volume and expect that in the near term, it will trade in a range. We could buy multiples of 100 shares at $40 or instead, we could buy $32 call options with one year to expiry. Because they are deep ITM the delta will be very high and most of the value of these options will be intrinsic value with little time value. $32 call options are $8 in-the-money and they cost us $9.40 instead of the $40 we would pay for the shares. This means we can either buy more of them or risk less capital.

To buy 10 long call option contracts at this price will cost us $9,400 instead of $40,000.

At the same time, we also sell 10 at-the-money call options with a strike price of $40 and only one month to expiry. We receive $130 for each contract we sell, at total of $1300 income.

Possible covered call writing scenarios at expiry date of the near month options:

1. The share price is below $40.

In this case the sold $40 call options will expire worthless and we keep the $1300. We still hold our $32 call options and we now sell more ATM call options for the next month out.

2. The share price is slightly above $40.

We then buy back the sold calls and immediately sell further call options at a higher strike price for the next month out, making a profit in the process, thanks to time decay.

3. The share price has made a strong move upward to around $50

The sold $40 call options will now be deep-in-the-money and we will be exposed by $10 per share, meaning that we will be forced to sell the shares at $40 when the market price is $50. But at the same time, we hold $32 call options which are now $18 in-the-money.

So we close out both positions. We make $10 profit on the $32 call options and lose $10 on the sold $40 options so one offsets the other. But we also get to keep the $1,300 from our original sale of the $40 call options.

The above covered call writing strategy is a great reduced risk alternative to the traditional covered call. Your sold options are 'covered' by the deep ITM options instead of the underlying shares themselves.

In fact, this strategy actually has another name - the Calendar Spread.

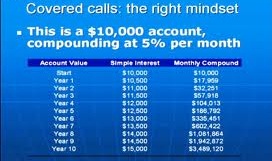

Overall, in one month our covered call writing strategy has made a profit of $1,300 on an investment of $9,400 which is 13.82 percent return on risk. Compare this to a strategy that included purchasing 1,000 underlying shares and we'd be looking at a return of $1,300 on a risk of $40,000 which is only 3.25 percent.

We then decide whether to buy more deep ITM call options based on the now $50 share price and sell near month ATM options again, or move on to another stock. Our decision will be based on whether we think the future price direction of this share is to remain steady or fall sharply again.

**************** ****************

Return to Covered Calls Contents Page

Go to Option Trading Homepage

New! Comments

Have your say about what you just read! Leave me a comment in the box below.